Are you tired of starting every month with good intentions, only to have your budget derail by week two? The truth is, figuring out how to create a monthly budget is only half the battle; the real financial freedom comes from mastering the discipline of how to stick to a budget. Budgeting is emotional. It’s influenced by stress, lifestyle, environment, and tiny everyday choices. And the people who stick to their budgets aren’t the ones following strict, unrealistic rules — they’re the ones using simple, flexible strategies that work even when life gets chaotic.

This article is your new guide, promising to move you beyond that initial, fleeting motivation by giving you simple, practical strategies that turn your financial plan into a lasting habit.

What Is a Budget, and Why Do You Need One?

A budget is simply a plan for your money. It’s an estimate of how much you expect to earn and how you intend to spend it over a specific period — weekly, monthly, or even yearly. Think of it as giving every naira a job so it doesn’t wander off on its own. Governments use budgets to plan national spending, businesses rely on them to operate efficiently, and individuals and families use budgets to stay on top of their finances. No matter your income level — salary earner, freelancer, business owner, or student — a budget helps you stay organised and intentional about your money.

Budgeting isn’t a one-time activity; it’s something you review and adjust regularly. Life changes, prices change, needs change, and your budget should change along with them. Beyond listing expenses, a good budget helps you set financial goals, measure your progress, and prepare for the unexpected. It acts like a roadmap, showing you where your money is going and how to redirect it if necessary.

So why should you budget? Because it gives you control. In a country where prices can change overnight and unexpected bills are common, having a budget can reduce financial stress. It helps you track your spending, avoid unnecessary debt, and make room for savings—even small ones. A budget also pushes you to prioritise: do you truly need that new gadget now, or should you top up your emergency fund first?

For businesses, budgeting is even more essential. It supports strategic planning, ensures resources are used wisely, and helps owners stay prepared for future expenses or growth opportunities. Whether you’re managing a shop, running a small online store, or handling finances for a growing company, a budget guides smarter decisions.

In short, a budget is your financial compass, it helps you stay steady, prepared, and in control.

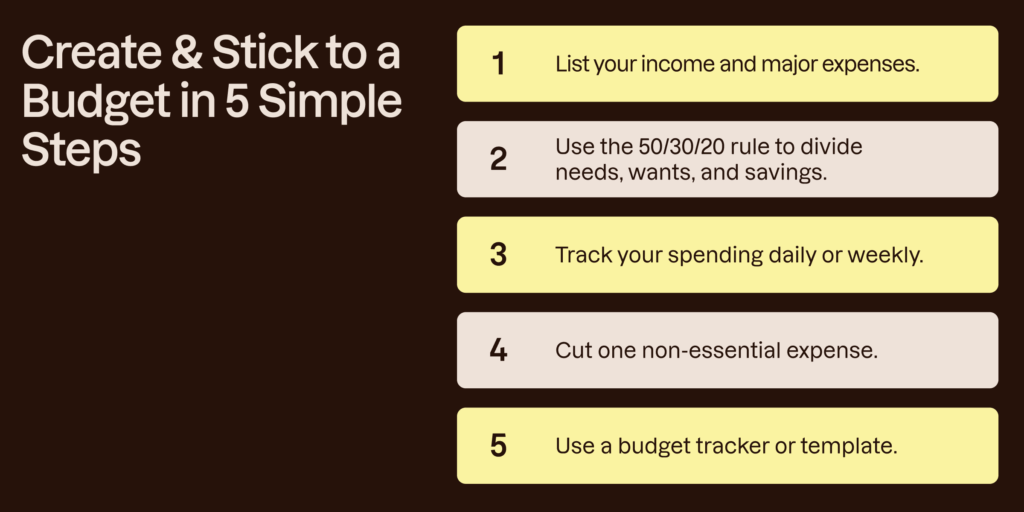

How to Create a Monthly Budget Using the 50/30/20 Rule

If you’ve ever wondered how to organise your money without feeling overwhelmed, the 50/30/20 rule is one of the simplest ways to start. It helps you divide your after-tax income into three parts: needs, wants, and savings. This approach works for salary earners, freelancers, and even small business owners trying to pay themselves consistently.

1. Allocate 50% to Needs

Needs are your must-pay expenses—the things you cannot skip. This includes rent, food, electricity, transport, school fees, minimum loan payments, and basic healthcare. In Nigeria, where essentials like food and transport can take up a big chunk of income, it’s important to track these closely. If your needs are taking more than 50%, try cutting back on wants or adjusting your lifestyle. This could mean moving to a more affordable area, choosing a cheaper transport option, cooking more instead of eating out, or sharing costs like fuel or commuting.

2. Allocate 30% to Wants

Wants are the extras that make life sweeter but aren’t essential. Think of your weekend outings, brunch dates, takeout meals, new clothes you don’t urgently need, subscriptions, vacations, or upgrading your phone when your current one still works. These things aren’t bad, but they should fit within your 30% limit. Being mindful here prevents lifestyle inflation especially when your income increases.

3. Allocate 20% to Savings and Investments

This final chunk is your future-proofing money. It includes your emergency fund, high-yield savings, retirement contributions, and investments like mutual funds, stocks, real estate savings, or even extra debt repayment. Aim to save enough to cover three to six months of expenses for emergencies such as job loss or medical surprises.

It also helps to use a simple budget tracker to stay on top of your income and expenses. You can download our free budget template here.

12 Practical Ways to Stick to a Budget

Sticking to a budget isn’t always easy—especially with rising prices, impulse buys, and unexpected expenses popping up every other week. But with the right habits, you can stay in control of your money and reduce financial stress. Here are twelve practical, Nigeria-friendly ways to stick to your budget without feeling deprived.

1. Sleep on Big Purchases

Before buying anything expensive, pause. Give yourself a week to think about it. Ask questions: Do I really need this? Will it affect my savings? Will this commitment — like a car loan — mess up my monthly budget? Often, what feels urgent today won’t seem so important after a few days. If you completely forget about the item during your waiting period, that’s a sign you didn’t need it. This simple habit alone can save you from plenty of regret and unnecessary debt.

2. Redefine What You Can Afford

Debt is easy to enter and difficult to escape. If you want something but can’t afford it right now, delay it. Plan for it. Save toward it. A holiday, new phone, or luxury item shouldn’t push you into months of financial struggle. It’s better to delay gratification than to “enjoy now” and “suffer later.” Smart financial decisions always pay off.

3. Stick to a Lower Credit Card Limit

High credit limits can tempt anyone. Keeping a smaller limit prevents overspending and ensures you only spend what you can repay quickly. A good rule: set a limit you could pay off with your emergency fund if you had to. It helps you build credit responsibly without drowning in interest.

4. Budget to Zero

Zero-based budgeting means every naira you earn has an assignment. After writing your budget, your income minus expenses, including savings, should equal zero. This method doesn’t mean spending everything. Instead, it keeps you intentional by ensuring that money doesn’t “disappear” on random expenses. It also keeps your budget flexible—you can shift categories when life happens.

5. Try a No-Spend Challenge

A no-spend challenge means spending only on essentials for a set time, like a week or a month. It resets your mindset, exposes wasteful habits, and boosts your savings. Want extra motivation? Involve friends or family and make it a friendly competition. You’ll be shocked by how much you save when you eliminate unnecessary spending.

6. Stop Paying for Unnecessary Fees

Subscriptions and little charges add up faster than you think. Do you really need Netflix, Prime Video, Showmax, and music streaming all at once? Review all recurring payments and cut those you barely use. Those “just ₦2,500 monthly” fees pile up and silently drain your budget.

7. Plan Your Meals

Meal planning helps you avoid impulse food purchases and reduces waste. When you plan your weekly meals, you’re less likely to buy things you don’t need. BONUS: You’ll probably make healthier choices, too. Pick recipes that share ingredients so your groceries stretch farther.

8. Do Your Grocery Shopping Online (or Use a Strict List)

If online ordering isn’t available near you, rely on a well-planned shopping list. Shopping without a list—especially when hungry—leads to impulse buying and bloated bills.

A list helps you stay disciplined, avoid distractions, and stick to your planned spending.

9. Pay Yourself First

Before spending on anything else, set aside money for your savings, emergency fund, or investments. Even small amounts count. Over time, they grow into something meaningful—like the new car you want, a house deposit, or backup funds for emergencies.

When you pay yourself first, you tell your money that your future matters.

10. Compare Brands Before Buying

Store brands or less popular brands often offer the same quality as their expensive counterparts. Always compare price, ingredients, and value.

If two items are basically the same, why pay more? Save the extra cash and push it toward savings or debt repayment.

11. Connect Your Spending to Your Work

Before buying something, calculate how many hours of work it costs you. This changes your perspective immediately. Example: If you earn ₦5,000 per hour, a ₦40,000 pair of shoes equals eight hours of work. Viewing purchases this way helps you spend more intentionally.

12. Reward Yourself When You Hit Your Goals

Budgeting shouldn’t feel like punishment. Celebrate your progress! If you hit a savings goal or stick to your budget for a month, treat yourself—responsibly.

Gamifying your budget makes the journey more enjoyable and motivates you to keep going.

If you need a simple tool to track your income and expenses, this free budget template will make things easier. Download it and use it as a guide to stay consistent with your money goals.