If you’ve ever had a sudden expense wipe out your account or force you to borrow money, you already know why an emergency fund matters. Learning how to build an emergency fund is one of the smartest money moves you can make. An emergency fund gives you breathing room when life happens, helping you stay afloat without taking loans, selling valuables, or spiralling into stress. If you’re starting from zero, don’t worry. This guide will show you simple, practical steps to save consistently, even on a tight monthly budget.

What is an Emergency Fund?

An emergency fund is money you intentionally set aside for life’s unexpected moments, the kind of expenses that don’t give warnings. Think of it as a financial cushion for situations like a sudden car repair, an urgent hospital bill, a faulty generator that needs fixing immediately, or even a temporary loss of income. These are not your regular monthly expenses; they’re the unplanned costs that can shake your budget if you’re not ready.

In simple terms, your emergency fund is your backup plan. It’s there to catch you when something unexpected happens, so you don’t have to scramble for money, borrow under pressure, or drain savings meant for other goals. Many people in Nigeria already know how unpredictable life can be—one rainy day can bring roof leaks, a minor illness can turn into a major bill, or a job can get delayed without notice. An emergency fund helps you stay steady through those uncertainties.

How Emergency Funds Work

An emergency fund steps in to handle expenses when your normal income can’t. If you suddenly lose your job or your salary is delayed, your emergency fund can help you cover everyday bills like food, transport, electricity units, and data until things stabilize. It also protects you from the financial shock of urgent events—whether that’s fixing your phone, dealing with home repairs, replacing a damaged appliance, or paying unexpected medical costs.

Without an emergency fund, one unplanned expense can disrupt all your financial progress. You may end up dipping into money you saved for rent, school fees, or investments, or even worse, turning to high-interest loans, payday lenders, or borrowing from friends and family.

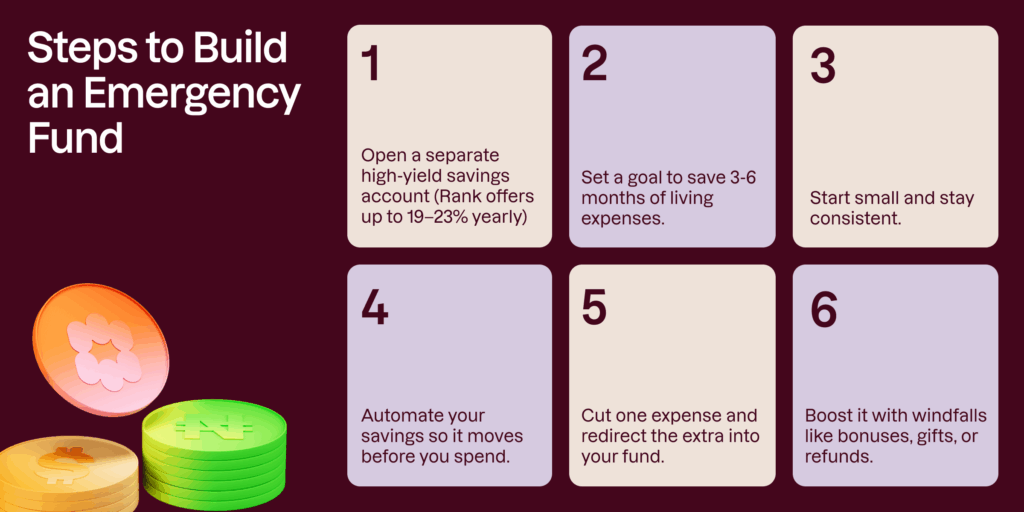

How to Build an Emergency Fund (Step-by-Step)

Starting an emergency fund might feel overwhelming at first, but the truth is, anyone can build one, no matter your income level. The key is to start small, stay consistent, and use the right tools. Here’s how to set up an emergency fund that actually works for you in Nigeria.

1. Open a Separate Savings Account

Your emergency fund needs its own home. Don’t keep it in the same account you use for transfers, airtime purchases, or daily spending—you’ll be tempted to touch it. Instead, open a simple savings account that:

- Is separate from your main account

- Has low or no transaction fees

- Let’s you withdraw quickly when an emergency happens

- Pays interest so your savings can grow

A high-yield savings account is ideal because it helps your emergency fund grow faster. If you want a simple option that pays well, Rank offers savings accounts that give you up to 19–23% interest per annum, helping your money grow while you stay prepared for emergencies.

2. Start With a Realistic Amount

You don’t need to save a huge amount at once. Even ₦1,000 or ₦2,000 a week is enough to get the momentum going. The real goal is consistency.

Ideally, you should aim to save 3–6 months of your living expenses or income, but don’t let that amount scare you. Break it into small weekly or monthly goals. For example:

- ₦1,000/week → ₦52,000/year

- ₦2,000/week → ₦104,000/year

- ₦5,000/week → ₦260,000/year

Small drops really do become oceans.

3. Make Saving a Habit

Integrate saving into your daily or weekly rhythm. Simple reminders can help:

- Set phone alarms or calendar reminders

- Drop loose change or leftover cash in a jar

- Use sticky notes in your room or workspace

- Create weekly “saving challenges” with yourself

The goal is to make saving something you do automatically, not occasionally.

4. Automate It

If your bank or app allows it, set up an automatic transfer on your payday. This way, your savings move before you spend it on transport, food, or impulse purchases. Automation removes the temptation to skip a week.

5. Cut One Expense and Redirect the Money

Look through your spending and identify what you can remove or reduce. For most people, it’s not the big bills—it’s the small habits. For example:

- Bring lunch from home instead of buying daily

- Make your own coffee

- Take public transport a few days a week

- Remove one “want” from your grocery list

- Use discounts and cashback apps

Redirect whatever you save straight into your emergency fund. These small changes add up fast, and if you keep that money in a high-yield savings account, you earn interest on top of these amounts.

6. Review Your Goals Regularly

Life changes, your budget should too. If you start a family, move houses, get a new job, or face higher bills, adjust your savings target. Even small lifestyle changes can affect how much you need in your emergency fund.

7. Increase Your Fund When You Can

Whenever you get extra money, channel some of it into your emergency savings. This includes:

- Tax refunds

- Bonuses at work

- Pay raises

- Gift money

- Money from selling an item

Also, when you finish paying off a loan, redirect that money into your emergency fund. Since it’s already part of your budget, you won’t feel the difference.

Tips to Help You Use Your Emergency Fund Wisely

Before you touch your emergency fund, pause and ask yourself one simple question: “Is this really an emergency?” Not every unexpected expense qualifies. Sometimes, it’s just something that can wait until your next payday or something you can plan and save toward.

If you’re unsure, return to your needs vs. wants list. A true emergency is a sudden, unavoidable need—something outside your regular budget that demands urgent attention. Think along the lines of a medical bill, a damaged roof during rainy season, a car breakdown on Third Mainland Bridge, or salary delays. That’s when your emergency fund steps in.

And when it is a real emergency, don’t feel guilty about using the money. That’s exactly why you built the fund in the first place—so you don’t have to borrow money at crazy interest rates, swipe your credit card under pressure, or call five friends hoping one will pick up.

At the same time, be disciplined. Because your emergency fund is easy to access, you might feel tempted to dip into it for things that aren’t really emergencies—like a last-minute aso ebi or a new phone you’ve been eyeing. Resist the urge. Protect that money. It’s your safety net, not your backup spending account.

Use it when you truly need it. Leave it alone when you don’t. That balance is what keeps your emergency fund strong and reliable when life happens.