Investing is like planning a trip. Stocks are the adventurous destinations that are full of excitement and potential surprises. Bonds are the travel insurance that keeps you covered when things don’t go as planned. Mutual funds are like guided tours: someone else handles the logistics and makes sure you see all the good stuff without the stress. The best investors, like smart travelers, mix a bit of thrill with plenty of security, enough to enjoy the ride and still make it home safely.

While most of us know how a simple savings account works, building long-term wealth or saving for retirement often means exploring other options. That’s where stocks, bonds, and mutual funds come in.

This guide breaks down the basics and helps you figure out which investment (or mix of them) might be right for your portfolio.

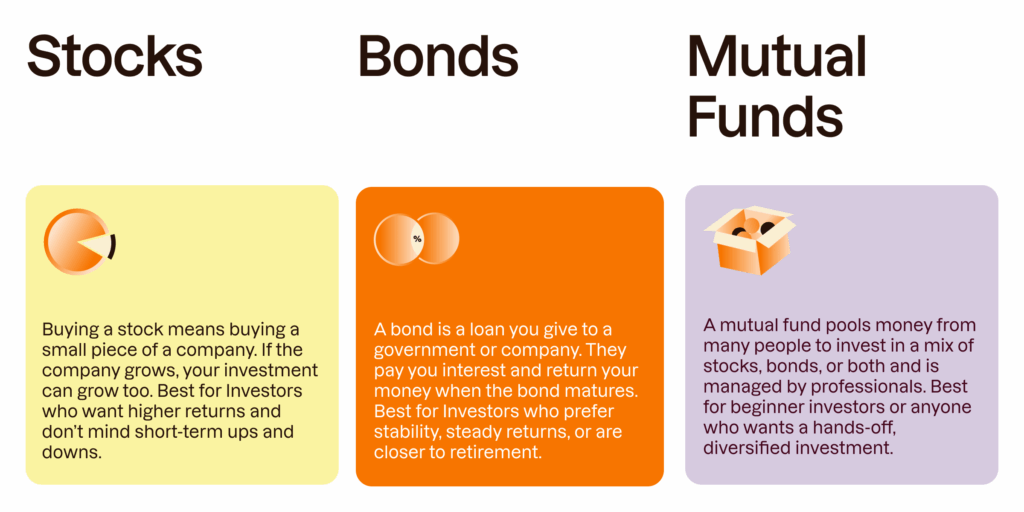

Stocks

Stocks, also known as equities or shares, represent a slice of ownership in a company. When you buy a company’s stock, you become a shareholder — a part-owner entitled to a portion of the company’s earnings and potential growth. If the company performs well, the value of your stocks may increase, and you may also receive dividends — cash payouts distributed from the company’s profits.

Companies list their shares on public exchanges like the New York Stock Exchange (NYSE) and the Nigerian Exchange Group (NGX) to raise capital for projects, expansion, or debt repayment. The first time a company offers its stock to the public is known as an Initial Public Offering (IPO).

Stocks are among the most accessible ways to invest in a business without actually running it. However, they’re also riskier than other types of investments because their value fluctuates based on the performance of the business, industry trends, and the broader economy. If a company performs poorly, the value of your stock may fall, and in extreme cases, you could lose your entire investment. On the other hand, stocks offer some of the highest potential returns which is why they form a key part of many long-term investment portfolios, especially for young investors with time to grow their wealth.

Bonds

If stocks are about ownership, bonds are about lending. When you buy a bond, you’re essentially loaning money to an entity — such as a government or corporation — in exchange for periodic interest payments and the promise to return your original investment (the face value) when the bond reaches its maturity date.

In Nigeria, one of the most popular types of bonds is the Federal Government of Nigeria (FGN) Bond, issued by the Debt Management Office (DMO). These are considered relatively safe investments because they are backed by the government. FGN bonds are used to fund important projects such as infrastructure, health, and education, and they are available to both institutional and retail investors through public offerings or licensed brokers.

Bonds provide a fixed income stream, making them attractive to risk-averse investors or those nearing retirement. In addition to government bonds, companies can issue corporate bonds to finance their activities. While corporate bonds tend to offer higher interest rates than government bonds, they also come with more risk.

Compared to stocks, bonds are generally considered safer — especially government bonds, which have the lowest default risk. However, their returns are also generally lower. Even though they are less volatile than stocks, bonds are not entirely risk-free, as changing interest rates or economic instability can affect their value.

Mutual Funds

Mutual funds offer a way to invest in a wide range of assets, like stocks, bonds, and even commodities, without having to pick and manage each investment yourself. A mutual fund pools money from multiple investors and uses it to buy a diversified mix of assets based on the fund’s objectives. For instance, an equity mutual fund invests mostly in stocks, while a fixed-income fund focuses on bonds.

In Nigeria, mutual funds are overseen by professional fund managers and are regulated by the Securities and Exchange Commission (SEC). These funds simplify the investment process for individuals by offering diversification and expert management in exchange for a fee. Some popular mutual fund providers in Nigeria include Stanbic IBTC, ARM, and FBNQuest, offering products that cater to beginner and seasoned investors alike.

Unlike individual stocks, mutual funds don’t trade on stock exchanges and are only priced once per day after markets close. This means you won’t be able to buy and sell them instantly throughout the day. Mutual funds can be actively managed (where managers make decisions about what to buy or sell) or passively managed (where the fund simply tracks a market index like the NGX All-Share Index).

One thing to note is that when you invest in a mutual fund, you don’t own the underlying stocks or bonds directly — you own units of the fund. This structure offers instant diversification and reduces your risk, because the fund spreads your investment across many different assets.

However, there are downsides. You have no control over what the fund manager buys or sells, and management fees (even though they may seem small) can eat into your returns over time. Plus, mutual funds are subject to market risks based on the assets they hold

Exchange-Traded Funds (ETFs)

While mutual funds help you pool your money with other investors, Exchange-Traded Funds (ETFs) offer a similar advantage with one key difference: they trade on the stock exchange just like individual stocks. This means you can buy and sell ETFs throughout the trading day, taking advantage of price changes in real-time.

An ETF is essentially a basket of assets — which could include stocks, bonds, commodities, or even a mix of several asset types. Some ETFs track broad market indices, such as the S&P 500 or the NGX All-Share Index. Others focus on specific sectors, commodities like gold, or even niche themes like clean energy or tech startups. This flexibility makes ETFs a popular choice for both new and experienced investors.

Investors often use ETFs as part of a wider strategy — whether that’s to generate income, speculate on price movements, or hedge against risks in a portfolio. One of the key advantages of ETFs is cost-efficiency: they generally come with lower fees than actively managed mutual funds, and you don’t need to pay high brokerage commissions to own a diverse group of assets.

Another benefit is transparency. ETF holdings are usually disclosed daily, so you always know what you’re investing in. This level of visibility, combined with the convenience of stock-like trading and lower costs, makes ETFs a practical option for those who want diversification without the complexity of picking individual investments.

That said, ETFs — like all investments — carry risks. Their performance depends on the assets they hold, so understanding what an ETF tracks is crucial before investing. However, for many investors, ETFs offer a simple, efficient way to access multiple markets and investment strategies in just one trade.

Frequently Asked Questions

1. What’s the difference between stocks and bonds?

The main difference is ownership versus loaning money. When you buy stocks, you’re purchasing a piece of a company and you now own a share in that business. Stocks are issued by companies to raise money for growth or new ventures. You can buy these shares from the company directly in the primary market or from another investor in the secondary market. Learning how to read a stock chart helps you understand price trends, spot patterns, and make smarter investment decisions.

On the other hand, bonds are like IOUs. You’re lending money to a company or government in exchange for regular interest payments and the return of your principal when the bond matures. As a bondholder, you’re a creditor, not an owner. Buying a 5-year Federal Government of Nigeria (FGN) bond means you’re giving the government money now, and they promise to pay you interest along the way, plus your full investment when the 5 years are up.

In bankruptcy cases, bondholders get paid before shareholders, which generally makes bonds less risky than stocks.

2. Are mutual funds better than stocks?

Not necessarily. It depends on your financial goals and how much involvement you want.

- When you might prefer stocks:

- You want direct control of your portfolio.

- You enjoy researching companies or following market news.

- You’re aiming for higher returns and are comfortable with the risk.

- You want dividends (regular income from company profits).

- You want direct control of your portfolio.

If you buy shares in MTN and they declare dividends, you get paid simply for being a shareholder.

- When mutual funds might work better:

- You prefer a hands-off approach.

- You want instant diversification (your money is spread across various companies/sectors).

- You’re okay with lower risk but also lower potential return vs. individual stock picking.

- You prefer a hands-off approach.

For example, a money market mutual fund from Stanbic IBTC lets you invest in a pool of bonds, stocks, and other assets with just as little as ₦5,000.

3. Are mutual funds safer than stocks?

Mutual funds offer diversification, which reduces risk, but they are not completely “safer” than stocks. If the market falls, the value of mutual funds can still drop though often not as sharply as a single stock might. A mutual fund may have some companies performing well and others underperforming, helping to balance things out unlike owning just one stock that underperforms.

4. Can I lose money in a mutual fund?

Yes. Mutual funds can decline in value, especially if the overall market is down. However, they spread out your risk across many securities (stocks, bonds, etc.), which can cushion against big losses from one company. If you invest in a balanced mutual fund with stakes in 20 companies and one company collapses, the impact on your investment is smaller than if you had owned only that one company’s shares.

5. How do I choose the right mutual fund for me?

Think about:

- Your risk appetite (Are you comfortable with ups and downs?)

- Financial goals (Are you saving for retirement or short-term gain?)

- Investment horizon (Do you plan to withdraw your money soon or leave it long-term?)

- Management fees (Check if the fund charges high fees which may eat into your returns.)

A retired person might prefer a bond fund offering stable returns, while a 25-year-old might choose an equity fund with higher growth potential.

6. Which is better: stocks, bonds, or mutual funds?

Each investment option has its own strengths:

| Investment Type | Strengths | Best For |

| Stocks | Higher potential returns, ownership in business | Risk-tolerant, hands-on investors |

| Bonds | Lower risk, regular interest payments | Income seekers, conservative investors |

| Mutual Funds | Diversified, professionally managed | Beginner or hands-off investors |

Your ideal choice depends on your goals, risk tolerance, and time frame. Often, a combination of all three (in a balanced portfolio) works best.

7. How do I buy stocks in Nigeria?

All you need is a stockbroker either a traditional firm or a modern investing app. They’ll help you get a CSCS number (like a BVN but for stocks) that identifies you in Nigeria’s stock market. From there, you can buy or sell stocks directly online. Apps like Bamboo or Trove allow you to buy shares of companies listed on the Nigerian Stock Exchange or even international markets right from your phone.

8. Where can I buy bonds in Nigeria?

You can buy bonds in three main ways:

- FGN Savings Bonds: Best for retail investors. Buy through DMO-accredited stockbrokers.

- Secondary Market Bonds: Via licensed brokers or banks known as PDMMs (Primary Dealer Market Makers).

- Investment Platforms: Some apps or fund managers offer bond investment options or bond funds with smaller entry requirements.

Always ensure the platform is licensed by the Securities and Exchange Commission (SEC) to avoid fraud.

9. How do you earn income from owning stock?

There are two main ways:

- Dividends: Your share of the profits.

Example: If a company declares a ₦100 million dividend and there are 10 million shares, each share gets ₦10. If you have 500 shares, you earn ₦5,000. - Capital Appreciation: Your stock becomes worth more over time.

Example: You buy a stock at ₦100 and sell it at ₦130, making a ₦30 profit per share.

10. Is it risky to own stocks?

Yes, stocks come with market risks like price drops due to company performance, global events, or economic downturns. But they’ve historically provided higher long-term returns compared to other investments.

11. What’s the best investment for me?

If you’re a high-net-worth individual looking for tailored strategies, consider premium services like Rank Premium, where your wealth gets VIP treatment. You get access to a private advisor, expert strategies, and potentially up to 30% per annum on curated investment options.