If your credit or debit cards could talk, it’d probably say: “Hey, I see you swiping me everywhere but do you really know how I work?” Between Netflix subscriptions, late-night food orders, and that “accidental” shopping cart checkout, it’s easy to swipe, tap, and move on. But not all your cards play the same role.

On one side, you’ve got debit cards: the “use what’s yours” type. On the other, credit cards: the “borrow now, pay later” specialist. They might look alike, but their personalities couldn’t be more different and knowing who to call for what situation can save you money, stress, and sometimes embarrassment at the checkout counter.

Let’s break it all down, card by card.

What Is a Credit Card?

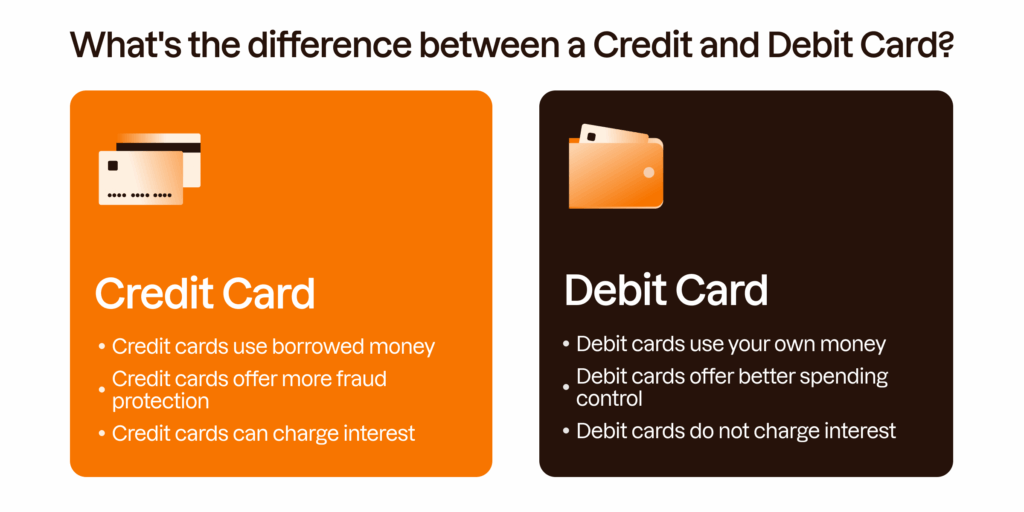

A credit card is like a short-term loan you can use to make payments. When you swipe or tap a credit card, you’re not spending your own money, you’re borrowing funds from the card issuer (like Visa, Mastercard, or a financial institution like banks) with the promise to repay later. If you don’t pay the full amount before the due date, interest (sometimes very high) will be charged on what you owe.

Credit cards often come with spending limits, cashback offers, reward points, and even travel benefits. You can shop online, pay for Netflix, or book a hotel stay using a credit card, even if you don’t have the cash in your bank account at that moment.

Imagine your fridge suddenly stops working, and the repair costs ₦200,000. You don’t have the cash right now, but with a credit card, you can fix the fridge immediately and then pay back the cost over the coming weeks or months — ideally before interest kicks in.

However, credit card adoption in Nigeria is still quite low due to cultural perceptions around debt and limited availability from banks. Most Nigerians tend to think: “Why borrow when you can spend only what you have?” And that’s fair, but modern financial planning shows that credit cards, when used responsibly, can be powerful tools.

What Is a Debit Card?

A debit card is directly linked to your bank account. Spending with it means you’re withdrawing money you already have. Most Nigerians are more familiar with debit cards. They’re the kind you get when opening an account with banks like Zenith, GTBank, or digital banks like Kuda and Moniepoint.

With a debit card, you can make ATM withdrawals, buy food at a restaurant, or pay for goods at a local POS machine. There’s no borrowing, interest, or repayment because it’s your funds being used immediately.

If there’s ₦50,000 in your account, and you try to pay for groceries worth ₦60,000, the transaction will likely fail — because debit cards don’t let you spend more than what’s in your account.

When Should You Use a Credit Card?

Credit cards are valuable tools for specific financial moves. In Nigeria where inflation and currency fluctuations are common, using a credit card wisely can help you preserve cash flow or even earn rewards.

Use a credit card when:

- You want to spread out the cost of a major expense: For example, fixing your car or replacing a damaged phone.

- You shop online often: Credit cards give extra fraud protection when buying from international websites or paying for Netflix, Spotify, or flight tickets on foreign platforms.

- You want to build a credit history: Although credit scores aren’t widely used in Nigeria the way they are in the US or UK, maintaining a good repayment history with financial institutions can still make it easier to get loans in the future.

- You want rewards: Some credit cards offer cashback on spending, air miles, discounts at restaurants, and more.

Let’s say you want to take advantage of Black Friday deals on Jumia Global or AliExpress, but you don’t want to immediately dip into your naira savings (especially if you’re waiting for your salary). A credit card lets you shop first and sort out the payment later, all while earning cashback or rewards.

When Should You Use a Debit Card?

Debit cards are perfect for day-to-day spending. They’re especially useful when you’re sticking to a budget and don’t want to get into debt.

Use a debit card when:

- You want to monitor your spending closely: Since it’s directly connected to your account, you can easily track what you’re spending.

- You’re on a strict budget: Spending your own money keeps you disciplined.

- You don’t want debt or interest payments: With debit cards, you never owe the bank anything.

- For quick cash withdrawals: Debit cards allow you to withdraw naira from ATMs across Nigeria.

Key Differences Between a Credit Card and Debit Card

| Feature | Credit Card | Debit Card |

| Source of Funds | Borrowed money from the issuer | Your own bank account money |

| Repayment | Required monthly; interest if unpaid | No repayment needed |

| Spending Limit | Set by issuer | Limited to your account balance |

| Interest | Charged if payment is delayed | No interest |

| Credit Score Impact | Can build or damage it | No impact |

| Rewards | Cashback, miles, etc. | Rare, usually no rewards |

| Best For | Big purchases, online shopping, emergencies | Day-to-day expenses, budgeting, ATM withdrawals |

FAQs About Credit and Debit Cards in Nigeria

1. Can I use a credit card in Nigeria?

Yes especially for online purchases, international subscriptions, or travel-related expenses. However, availability may be limited depending on your bank.

2. What kind of cards do Nigerian banks offer?

Most banks offer debit cards (Verve, Visa, Mastercard). Some also offer prepaid or credit cards, but they often come with stricter requirements (like salary accounts or deposits).

3. Do credit cards work for dollar payments in Nigeria?

Yes, some credit cards are dollar-denominated or allow international usage. You’ll be charged in naira at the official bank rate for foreign transactions.

4. Which is better, a credit card or a debit card?

There’s no one-size-fits-all answer, it all depends on your financial habits and needs. If you want to build your credit history, earn rewards, or enjoy stronger consumer protections (especially for online or international purchases), a credit card is a better fit. However, if you’d rather avoid debt and limit your spending to what you currently have, then a debit card is the smarter and safer choice. It keeps your spending tied to your bank balance.

5. Is an ATM card a credit or debit card?

An ATM card is a type of debit card designed primarily for cash withdrawals at ATMs. Traditional ATM cards could only be used to withdraw money or check your balance. But today, most debit cards in Nigeria double as ATM cards, they allow you to make purchases in-store, online, and at POS terminals, as long as they carry Visa, Mastercard, or Verve logos.

Here’s a quick breakdown:

- ATM Card: Used mainly for cash withdrawals; linked directly to your bank account.

- Debit Card: Works as an ATM card but also lets you make payments wherever cards are accepted.

- Credit Card: Not linked to your bank account — it allows you to spend borrowed funds, which you’ll repay later.

6. What happens if I don’t repay my credit card bill on time?

Interest and penalties will be added to your balance, and your card may be restricted until payment is made.

7. Which card should I choose for small everyday purchases?

A debit card is ideal for routine spending like transport fare, groceries, and airtime top-up.

8. Can a credit card be used in an ATM?

Yes, it can — but be cautious. Using a credit card to withdraw cash is called a cash advance, and it’s usually very costly. Not only are there steep fees, but interest starts adding up immediately, unlike regular purchases which may have a grace period. As a rule of thumb, avoid using your credit card at an ATM unless it’s an emergency.

9. Why should I get a credit card?

A credit card can be a smart financial tool — when used responsibly. Here’s why people choose them:

- Safer than cash or debit – you’re not directly exposing money in your account.

- Helps build credit – timely payments on a credit card help you build a solid financial profile.

- Rewards and perks – from cashback on fuel to air miles or special dining offers.

- Track your spending easily – every purchase is recorded, which helps with budgeting and financial planning.

10. Which is safer, a credit or debit card?

A credit card is generally safer than a debit card, especially when it comes to fraud. If someone uses your credit card fraudulently, the money comes from the bank’s funds — not your account. You’re usually not liable for unauthorized transactions, and resolving disputes doesn’t affect your cash flow. With debit cards, however, stolen funds are taken directly from your bank account, and you may never recover your funds. It’s important to follow best security practices no matter which card you’re using.